The real estate market often fluctuates, selling a house does not always result in a profit, and there are also cases where the seller suffers a loss.

In recent days, the real estate market has been very concerned about the information that the Ministry of Finance has proposed to impose a 20% tax on real estate transfer profits. This means that when people sell a house, they will have to pay tax on the profit they earn compared to the time of purchase.

The Ministry of Finance has just sent a report to the National Assembly deputies on the implementation of the National Assembly’s resolutions and on the questioning activities at the 15th National Assembly sessions in the financial sector. Notably, the Ministry of Finance said that in the process of amending the Law on Personal Income Tax , the ministry is studying the application of two tax calculation methods, depending on information on real estate transfer transactions .

Option 1 will apply tax on the transfer profit, in case the database accurately determines the purchase price and related costs. Currently, the tax rate proposed by the Ministry of Finance is 20%. Option 2, if the purchase price and related costs of the real estate transfer cannot be determined, the tax calculation on the total transfer price of the individual’s real estate will be applied, with an expected tax rate of 2%.

Since 2015, according to the law amending and supplementing a number of articles of the Law on Personal Income Tax, real estate transfer transactions are subject to a personal income tax rate of 2% of the total value of the transferred real estate.

Currently, when buying and selling real estate, the seller is subject to a tax rate of 2% on the total value of the house. However, according to the explanation from the Ministry of Finance, the control of state agencies to ensure that buyers and sellers record the transaction price on the contract at the correct actual transaction price is still inadequate. Currently, the tax authority’s database has the function of looking up the transaction history of the land plot and looking up the transaction history of the taxpayer (from 2018 to present). However, the transfer price recorded on the contract is still not guaranteed to be correct with reality. From there, this agency has researched and proposed a new tax calculation method.

The houses in the alley can have a market price of 10 billion VND. However, when buying and selling, the buyer and seller sometimes only make a transfer contract of 5 billion VND. By doing so, when they pay 2% personal income tax when transferring, instead of having to pay 200 million VND, they reduce it to 100 million VND. Thus, the State’s tax collection will be lost, this is a common practice in the market recently.

Having worked in the real estate market for many years, Mr. Bac frankly stated that the current method of calculating personal income tax for sellers at 2% of the house value is quite simple and easy to collect. However, this method creates a big loophole in the declaration of selling prices. To reduce the amount of money to be paid, buyers and sellers often join hands to declare a transfer price much lower than the actual price when making notarized contracts. Therefore, a new method of calculating taxes is considered necessary.

“If we have a database and are transparent about that, it would be great, but the challenge is transparency, how to calculate the revenue and expenditure sources to make a profit for a real estate transaction. To do this, I think it will take a very long time for the State to compile statistics and control the transaction,” said Mr. Nguyen Van Bac – Chairman of BTN GREEN Company.

However, some opinions are still concerned about the implementation, avoiding strong fluctuations in real estate transactions.

Mr. Ngo The Vinh – Chairman of Vinh Gia Real Estate Company shared: “I think it is reasonable, but the problem is the time of application. In my opinion, this time is not suitable because the market is not transparent. When calculating taxes, it will create a lot of negativity, because at that time it completely depends on the tax calculation staff.”

“It will affect the market, because in the past there were properties whose exact purchase and sale value at that time was not clearly determined. This project also needs to be further studied to make accurate decisions,” said Ms. Nguyen Thi Thuy Linh – Deputy General Director of Sales of G.Empire Company.

The Ministry of Finance also believes that in order to calculate tax using the method of applying the profit on real estate transfers, two conditions are needed. That is, there must be a database that accurately reflects the transaction prices of the transfers. Along with that, the competent authority needs to clearly stipulate the deductible expenses and the conditions on invoices, documents, and cost price of the transferred real estate.

Comments on proposal to tax real estate transfer profits

The proposal of the Ministry of Finance is to apply one of two methods of calculating real estate transfer tax. Either keep the current method of calculating tax at 2% of the total value of the property or apply a 20% tax on the difference between the purchase price and the sale price. Experts say that some problems may arise if implemented. Therefore, careful calculations are needed.

Suppose a house is sold for 10 billion VND. After deducting expenses such as bank loan interest and any repairs and renovations, the homeowner earns a profit of 2 billion VND compared to the time of purchase. If the 20% tax rate on the profit is calculated as recently proposed by the Ministry of Finance, the seller will have to pay 400 million VND in tax.

If the current method of calculating 2% of the house value of 10 billion VND is applied, the seller will have to pay 200 million VND. Obviously, the difference between the two tax calculation methods is quite large.

“If it is a law, if it is a regulation, then only one should be applied, but if it is one of two, then there should not be two regulations because surely people and traders will choose the more beneficial one,” said Mr. Nguyen Van Bac – Chairman of BTN GREEN Company.

Some buyers are concerned that the real estate market is often volatile. However, selling a house does not always result in a profit, and there are also cases where the seller suffers a loss.

“20% of the transfer profit is high for people who really want to buy a house like me. For example, bank interest, brokerage fees, and repair costs are all added together. If we calculate the transfer profit based on the original home purchase invoice, the fee is too high,” said Ms. Dang Thanh Nga, Hanoi.

Since the end of 2024, localities have successively announced new land price lists, which are the basis for calculating taxes when transferring real estate. The new price list is closer to market prices. For example, the adjusted land price list of Ho Chi Minh City has increased by about 4-38 times, the highest level is nearly 700 million VND/m2. In Hanoi, land prices have also increased by 2-6 times. Therefore, many opinions suggest that in the case of buying and selling houses without full invoices and documents, the basis for calculating profits and losses, the method of calculating personal income tax for sellers should continue to be applied at 2% of the total value of the house, determined according to the new land price list, similar to the current method.

Tax policy on real estate profits in some countries

Real estate transfer is not only a popular economic activity but also an important source of revenue for the national budget. Many countries have had to constantly adjust their personal income tax policies from real estate to reflect the true nature of profits. Here are typical examples from the UK, the US and Malaysia.

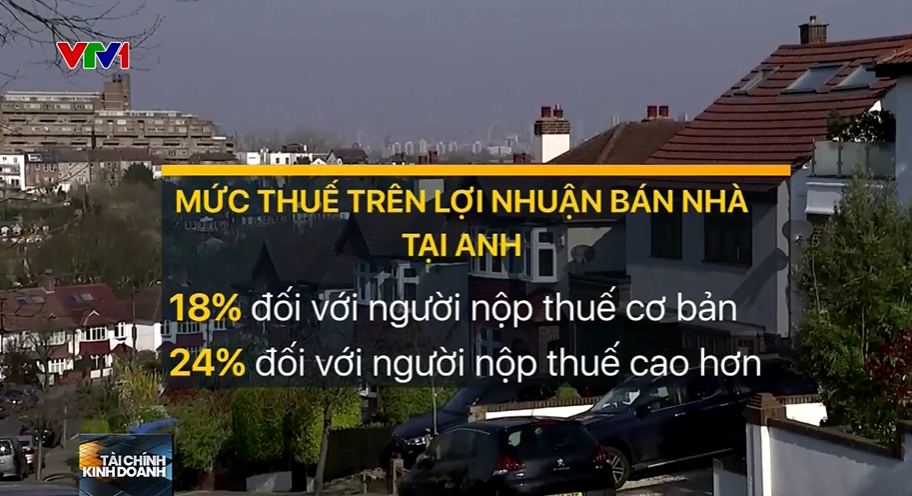

In the UK, the personal income tax model for property is capital gains tax, with exemptions for main residences. The current rates are: 18% for basic taxpayers and 24% for higher taxpayers, and apply to profits from the sale of non-main residences. However, if a UK homeowner wants to sell their main residence, the profits from this are tax-free provided they meet the residency requirement.

In Malaysia, the tax rate on real estate profits ranges from 10% to 30% depending on the period of holding the property. In addition, there are tax exemptions and incentives for primary residences and other special cases.

The tax rate on home sales is currently 0%, 15% or 20% in the US, depending on the taxpayer’s income. In addition, profits from the sale of a primary residence are tax-free up to $250,000 for singles and $500,000 for couples, if residency requirements are met.