n order to accelerate in the fourth quarter of 2024, experts say that solutions to support businesses and people after Typhoon Yagi need to be implemented very quickly. In terms of days, GDP growth in the fourth quarter of 2024 will only reach 7.4%, from which GDP growth for the whole year can reach the target of 7% as set by the Government…

Recalling the severe damage that super typhoon Yagi has just caused to the northern provinces at the Policy Dialogue: “Growth recovery – Prospects and challenges” organized by the Vietnam Institute for Economic and Policy Research (VEPR) on October 15, Dr. Phan Duc Hieu, Standing Member of the National Assembly’s Economic Committee, said that the typhoon will not immediately affect growth in the third quarter of 2024 but will affect growth in the following quarters, first of all in the fourth quarter of 2024.

“Therefore, it is necessary to implement the Government’s Resolution on supporting the recovery of the consequences of Typhoon Yagi very quickly, in a matter of days, to achieve high growth in the fourth quarter of 2024 and thereby achieve the annual GDP growth target of 7%…”, Dr. Hieu noted.

ECONOMIC GROWTH WITH MANY BRIGHT SPOTS

Looking back at the growth in the third quarter of 2024 – the time when Typhoon Yagi made landfall in the North, Mr. Nguyen Quoc Viet, Deputy Director of VEPR, said that by the end of the third quarter of 2024, Vietnam’s economy had recovered relatively well amid optimism about the overall growth of the world economy in late 2024 and 2025.

Specifically, GDP growth after 9 months reached 6.82%, 1.5 times higher than the 4.4% in the same period last year, with the main contribution coming from the industrial and service sectors.

On the supply side, the agriculture, forestry and fishery sector, which was affected by Typhoon Yagi, saw its growth rate decrease from 3.43% to 3.2% year-on-year. Services continued to grow by 6.32% year-on-year, thanks to the revival of tourism and the trade and transport sectors maintaining their growth momentum.

Meanwhile, the industrial and construction sector increased sharply to 8.19% compared to the 2.41% increase in the same period last year, thanks to the recovery in the processing and manufacturing industry, contributing 2.44 percentage points to the total added value growth of the entire economy.

On the aggregate demand side, recovering trade and positive FDI inflows are the main growth drivers.

“Notably, import and export of goods far exceeded expectations, with a total turnover of 578.5 billion USD, a sharp increase of 16.3% over the same period, and a trade surplus of 20.8 billion USD. It can be considered an outstanding achievement in the 2020-2024 period,” Mr. Viet emphasized.

However, consumer spending remains below pre-pandemic levels and inflationary pressures in the first half of 2024 also dampen capital growth.

In addition, realized FDI capital reached a record high, estimated at more than 17.3 billion USD, up 8.9% compared to the first 9 months of 2023. Tourism recovered strongly, in the first 9 months of the year, international visitors to Vietnam reached more than 12.7 million, up 43% over the same period last year.

The USD exchange rate at domestic commercial banks has continuously decreased, with the price much lower than the ceiling set by the State Bank. The growth rate of money supply and credit growth has recovered quite well, contributing positively to promoting growth and investment, although it is still lower than the average before the Covid-19 pandemic.

The State Bank has continued to implement relatively successful flexible monetary policies in the recent period to reduce shocks and intervene in liquidity, helping to lower interest rates and support capital costs for the economy without having to intervene in operating interest rates.

2 SCENARIO FOR VIETNAM’S ECONOMIC GROWTH IN 2024

Despite many positive highlights, the Deputy Director of the Institute for Economic and Policy Research noted that there are still risks and challenges that the economy is facing.

Accordingly, the manufacturing purchasing managers index (PMI) declined and fell below 50 points in September. The rate of enterprises withdrawing compared to enterprises entering the market remains high. Domestic consumption and public investment disbursement have not met expectations.

Mr. Viet added that foreign direct investment (FDI) flows, which are the main driver of growth in Asian countries, including Vietnam, are showing signs of slowing down in the third quarter of 2024.

“Accordingly, it is necessary to carefully study the FDI capital flows in the world in general and into Vietnam in particular to have corresponding policies in the coming time,” said the Deputy Director of VEPR.

Looking further ahead, weaker-than-expected US consumption and manufacturing demand, a sharp slowdown in growth in Europe, and slowing growth in China could disrupt the export recovery and weaken Vietnam’s growth rate.

“Balancing growth drivers, especially between export drivers and domestic market growth, ensuring macroeconomic stability and sustainable growth is urgently needed in that context,” Mr. Viet noted.

Meanwhile, input factors in production face many barriers as well as difficulties in transforming the growth model, innovating the business environment and reforming institutions. Although some progress has been made, it is still slow, posing many risks in investment and business, discouraging the domestic and foreign business community.

At the seminar, economic expert Pham Chi Lan also shared that growth in the third quarter still relied on exports thanks to the hands of FDI enterprises, while the driving force from domestic consumption and investment has not increased much due to the impact of the Covid period until now.

In addition, according to Ms. Lan, the underdevelopment of domestic supporting industries and micro, small and medium enterprises (MSMEs) has hindered the country’s efforts to get on the global value chain map, increasing the gap between the foreign-invested economic sector and local enterprises, creating what many people have recently worried is two parallel economies.

The business environment still has many potential risks, with barriers in business conditions and administrative procedures not only not being reduced but also tending to increase, due to the weakening reform momentum from ministries and branches.

“If we do not achieve our development goals this year, it will affect the following years,” Ms. Lan emphasized. “The achievements in the third quarter of this year give us confidence to recover and continue to develop in the coming years.”

Notably, Mr. Phan Duc Hieu, Standing Member of the National Assembly’s Economic Committee, agreed that the challenges in the last months of 2024 are still very large. In particular, the damage caused by Typhoon Yagi has not yet been completely overcome, severely affecting the production and business activities of both enterprises and people. The rapid implementation of post-typhoon support policies is necessary to promote economic growth.

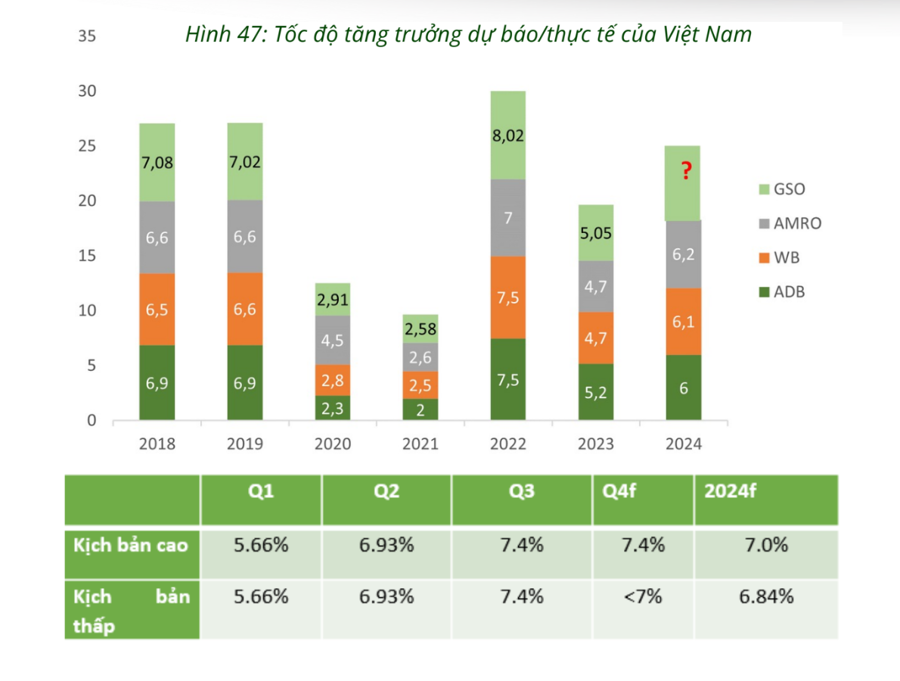

In the context of mixed advantages, difficulties and challenges, VEPR proposed two high and low scenarios. With the high scenario, growth in the fourth quarter of 2024 will be flat at 7.4%, and growth for the whole year of 2024 is expected to reach the new target of 7.0% set by the Government for 2024.

In the low scenario, Q4 growth will be below 7%, with full-year 2024 growth forecast to hover around 6.84%.